Automating the middlemen of communities

Blockchain replaces middlemen with code. I analyse what this means for DAOs, argue that DAOs must pick between expertise and community, and explore those doing it best at both ends of the spectrum.

This is the first in a three part series analysing what makes DAOs interesting, who should build them, and how to navigate the trade-offs. It’s nowhere near so long.

Part 1, this one: an introduction to DAOs & the community-expertise trade-off

Part 2, Nov 1st: pursuing expertise amidst community tensions

Part 3, Dec 1st: pursuing community amidst expertise tensions

My argument in part one is that DAOs have two advantages over other organisational structures, in administration and banking, and that these advantages lend themselves to very different organisations, one built around expansive community, the other on expert partnership. However, trying to build a DAO around both advantages causes inevitable tensions; the parts for the next two months focus on navigating them.

Contents:

Blockchain automates middlemen

The middlemen automated by DAOs

A framework for analysing DAOs

High-influence, high-stake DAOs

Low-influence, low-stake DAOs

Tensions between influence and stake

Blockchain automates middlemen

One of the first things that made me take notice of web3 was this quote from Vitalik Buterin, co-founder of the Ethereum blockchain:

“Whereas most technologies automate workers on the periphery, blockchains automate the centre.

Instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with the customer directly.”

Specifically, Vitalik is talking about the part of Uber that matches drivers with customers, taking a cut on the fare in the process. They do this by having all of their drivers on a big database, which their algorithm picks from to find you a driver. The reason Uber can take a quarter of every fare is that only Uber has this database.

The promise of blockchain is to automate middlemen like this. Essentially, a blockchain is a very secure database that anyone can view and contribute to. Instead of being on Uber’s database, taxi drivers could all be on a blockchain. You could access the same driver via Lyft, competing to connect you with the same drivers1.

I’m interested in how blockchain automates the middlemen of communities. In web3, these are known as DAOs: decentralised autonomous organisations. I’ll explain:

Decentralised: All community members vote on…

Autonomous: …whether to spend money on a particular cause…

Organisation: …which helps them achieve a shared goal.

A DAO is essentially a piece of code that runs permanently on the blockchain; it cannot be reversed like a credit card transaction or deleted like a tweet. These programmes are called smart contracts, and can hold digital assets, including money, that are dispensed only when the community votes to do so2.

Much like traditional organisations, they comprise people united to achieve a goal. Through collaboratively controlling the treasury, DAOs control their organisation. Note, however, that the technology does nothing to provide the political and social influence to lead, just full economic control.

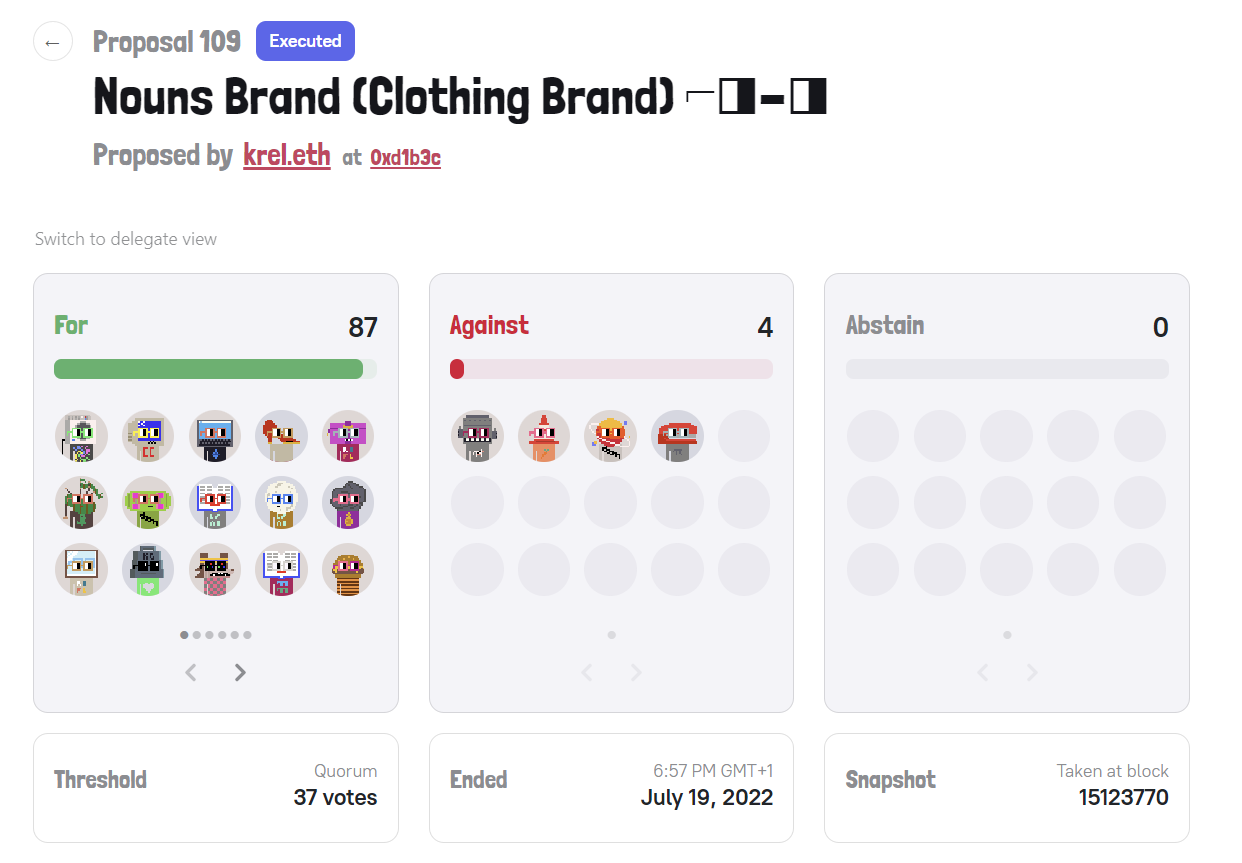

As for the votes, these correspond to the funds you contribute to the group. Nouns DAO members have a vote for every Nouns token they have bought; Uniswap voters each hold a quantity of UNI, the platform’s currency in which fees are paid and earnt. With one minted every day, there are just 462 Nouns, but 1 billion Uniswap tokens.

Fundamentally, a DAO is how people can pool and allocate money. At Culture3, we published a great article on cooperatives, exploring the counter-cultural organisations built on the idea that groups of people can pool funds towards common interests. But take out the phrase ‘counter-cultural’ and you have the stock definition of a DAO.

Which middlemen do DAOs automate?

In that article, one of the communes we profiled is called Cabin, whose founder gave this explanation for choosing a DAO:

“We didn’t intend to be a DAO. The DAO tools were the best tools to accomplish what we were trying to accomplish.”

Clearly, DAOs are changing the decision landscape.

We should conceive of middlemen as essential bottlenecks. We pay Uber a 25% cut because we need them to connect us with a driver. Similarly, organisations park their money in a group bank account because if they just gave it to one individual, that individual could say ‘let me do what I want, or I’m taking the money’. These groups also require some administrative infrastructure to decide how to use the money and then pay it out. Removing these bottlenecks means that new types of organisations, where those bottlenecks were insurmountable, can form3. And they’ll do so as DAOs.

Administration at scale

By automating much of the work required to collaboratively distribute funds, DAOs make it easy for new organisations to operate at scale.

Without a DAO, it is very hard to administer the voting and management roles implied by an organisation of thousands or millions. By contrast, DAO let you give tokens to those who contribute and use a tool like Snapshot to restrict voting only to those with the token, all verified irrevocably onchain.

But what is new is connecting a large number of individuals to the treasury specifically. Google could give everyone a vote on their next logo: it’s giving those users control of the money to make that change happen that has let organisations such as Nouns raise enormous sums ($40m) and administer them collaboratively. DAOs automate much of what is effectively the admin work of scaling governance.

Bankless collaboration

Beyond scale, DAOs make it easier for groups of all sizes to pool funds seamlessly, and service DAOs testify to this. Selling services from software development to PR, these DAOs are similar to traditional partnerships, such as RaidGuild, a service DAO of 178 developers (CoinMarketCap). In this case, income from clients is distributed across contributors (as payment) and the treasury (to invest in the DAO).

Of course, organisations could just get an international Airwallex account, but the advantage of DAOs is managing the money collaboratively. There’s not a huge difference between international and domestic organisations. Indeed, there’s a strong argument that DAOs could be more efficient as a structure even for domestic groups, upon achieving comparable legal status like in Wyoming. Ultimately, DAOs make it easier for people to spend funds collaboratively by automating the work of banks.

Who joins a DAO? A framework

DAOs make it easy for communities to pool resources. But it is just a structure: there are myriad ways in which this structure can be adopted and adapted. Understanding the contexts in which people join DAOs is key to understanding the communities that they produce, and thus who should build them.

Joining a DAO comes with entry costs: you’re asked to introduce yourself to thousands on a Discord channel and a forum, read up on key issues, and form your own judgement. In addition, you might want to make proposals of your own or contribute in other ways, like signing up to provide a service in a service DAO.

It takes a reasonable amount of effort to participate in a DAO. Later on, I’m going to split DAOs between whether their members have a low or high stake in its success, but really, we should not think of any member having a low stake; some will care more than others, but every member who pays the entry costs will have some reason to care.

The reward for this participation is influence over the DAO’s resources. This is affected by vote share, centralisation, and internal prestige. Most obviously, the greater your vote share, the greater your influence. Centralisation is more ambiguous, but usually, other voters centralising means they are more likely to collaborate and exclude you4. Prestige is simple: through contributing, you build a reputation inside the DAO that gives you social influence over other people’s votes. Vote share and prestige increase influence; centralisation reduces it.

Influence interacts with your stake to determine how much an individual engages in the DAO. You could imagine a DAO where you have a 40% vote share governing a treasury of £100; high influence, small fry. Whilst influence is how important your votes are relative to the other votes, stake is how important your votes are relative to the other things you care about.

Organisation value, exit value, and community value matter here. Organisation value is how important an organisation’s services are to you: how much you care about your Uniswap tokens depends on whether you use Uniswap or a competitor. Community value is any pleasure or social prestige you receive from being a member of a DAO, whilst exit value is the profit (or loss) you could make on your tokens if you contribute to the DAO (or don’t): the greater this is, the more willing you are to contribute.

My argument is that the two structural advantages of DAOs, in admin and banking, lend themselves to very different organisations. Automating admin bottlenecks mainly makes it possible for expansive communities to align around a vision. Automating the banking bottleneck makes possible more expert-driven collaboration. But these are two very different organisations and tensions necessarily arise when they are tried simultaneously. DAO design decisions are convex. Let’s dive deeper to see how this plays out.

Specifically, problems ensue when DAOs cause a mismatch between stake and influence. DAOs that assign high levels of influence to members that have less at stake face tensions because other community members feel ignored. By contrast, those in which members have a high stake but limited influence face difficulty executing on the details.

Instead, DAOs are better off pursuing either end of the spectrum. Communities of high-stake, high-influence members built upon collaborative banking are well-placed to form efficient organisations that effectively leverage high expertise. Communities of many low-stake, low-influence members built upon easier administration also have a role, operating where the benefits of community exceed those of expertise.

The chart above brings this idea to life. DAOs fall on a spectrum between creating value from their community (top-left) and creating value from their expertise (bottom-right). Community DAOs have many members each with low influence and a low stake in the DAO. Expertise DAOs are the opposite: far fewer members implies greater individual influence, and those accepted typically have higher stakes.

High-influence, high-stakes

This series is really to analyse the tensions of DAO design, but I want to close this first post by briefly exploring what these two types of DAOs look like when designed very well. Let’s start with expertise DAOs, which are far more familiar, where members have high influence and high stakes.

DAOs which afford their members high influence naturally prioritise selecting members with high stakes. If you’re going to be a 50 or 200 person DAO, you need everyone to pull their weight, so you prioritise people who will care. And of these, DAOs will choose people with the expertise most to contribute.

Examples crop up from investors to communes. MetaCartel comprises 61 investment ‘mages’, whilst LAO is limited to 99 accredited US investors (showing how DAOs can be preferable even within national borders). As for communes, Kift has ~240 members (OpenSea), whilst CabinDAO is at 154 (Snapshot). To add to the breadth, RaidGuild is a service DAO for software development with 179.

Given their expertise and high stake (the communes are for co-living!), members are willing and able to make larger contributions. These DAOs have a technical flavour, able to create operational efficiency in the short term and sustain that for the long term. Members are familiar with the goings on in the DAO, allowing them to make inter-connected, strategic decisions rather than just isolated yes/no votes, and enforce stronger accountability, contributing to the social and political influence required to lead that is built online but not onchain.

Low-influence, low-stakes

At the other end of the spectrum we find organisations with members who have low influence and low stakes. This is a necessary consequence of organising at enormous scale and thus leaning towards the administrative capabilities that DAOs provide. Such organisations are open to anyone with an internet connection, and their breadth reduces everyone to low influence. You would only put a low stake into a group over which you have low influence; it would be wrong to say they didn’t care at all, but few will contribute in the ways seen above. Such DAOs lean towards broad community rather than incentivised expertise, and succeed in areas where expertise is less useful than what you can get from a community.

One example is trust. This is a point recently made by Vitalik Buterin, co-founder of Ethereum. By facilitating collaboration between thousands of people, together, they can help us make trusted, subjective judgements. His blog is the place to go for a focused overview, but simply put, these DAOs let communities collaboratively choose what should be trusted, challenge decisions that we think are wrong, and vote by vote, inch our way towards an objective truth. The general idea is that low-low DAOs help us circumvent the middlemen that we rely on to trust things.

For example, Kleros is a decentralised court that in many cases offers a cheaper, quicker alternative to enforcing contracts5. Other examples include maintaining currency pegs (stablecoins), verifying information stored on the blockchain (oracles), and storing files. A key attribute is that ongoing membership is passive and costs little.

But I think Vitalik misses part of the picture when framing broad community DAOs as simply a choice of trust over expertise. Really, it is a choice of community over expertise. Whilst low participation by many people can provide for trustworthy institutions, it can also provide for other things. The advantages of low-low DAOs is essentially the answer to the question ‘what can people do by just turning up?’

Crowdfunding money for a fundraiser (rather than crowdfunding time for a jury) is one key strand of low-low DAOs. For example, ConstitutionDAO was created to buy a copy of the US Constitution. It was organised by four friends who solicited donations, but donors were not required to do anything else: a glorified Kickstarter. But Kickstarter has raised $7bn for over 200,000 projects; glorifying it is no bad thing.

Onwards to part 2

High-high DAOs and low-low DAOs comprise some of the best organised in web3 and some of the best examples of what DAOs can offer. And though they achieve success with different organisational tactics, they follow the same strategy: choose goals that can be achieved by a community of people whose stake is commensurate with their level of influence.

High-high DAOs do this by focusing on expertise-oriented goals that take much thought and planning to achieve, because their concentrated and experienced members are incentivised to make effective contributions to the DAO.

In low-low DAOs, the planning comes before the DAO launches, creating incentives under which large numbers of people choose to contribute individually small amounts towards goals that broad communities are best-placed to achieve.

However, not all DAOs are in such a well-aligned position. Some have members with a high stake, but whose influence declines as the DAO grows. For example, many high-high DAOs, like service DAOs, respond to incentives (like the benefits of a broader community) to expand, but they face problems executing on the details when broad communities turn into weeds. Braintrust, a freelancer DAO, is a potential example.

Others exist where members do not necessarily have a high stake, but face tensions as larger members concentrate and dominate the DAO. Seeking the benefits of expertise, many DAOs, particularly low-low ones and those in technically-complex areas, respond to incentives to give better-informed members greater influence in the community. Uniswap, a currency exchange, is an example.

Being in these quadrants is not necessarily a mistake. Rather, it is a step in a DAO’s evolution as an organisation. But when what people have at stake does not match the influence they hold, tension necessarily ensues. The next two posts will explore how to navigate those tensions.

Would a blockchain taxi protocol be good? Drivers would access to more jobs (they can now drive Lyft users), whilst the companies would compete on lower fees and user experience (such as safety) to attract users. Uber loses out, because blockchain automates the proprietary database that makes them a powerful middleman. If Uber tried to take a 25% cut on the blockchain platform, Lyft has access to the same driver, and would offer to take a lower cut.

Others have slightly tweaked definitions for what a DAO is (see a rebuttal to that definition here), but I have found that others generally agree with my own.

DAOs are often associated with other advantages around transparency and early growth, but this is less to do with the underlying technology. Organisations of all types could have always embraced these features – if they had chosen to:

Transparency: transparency comes because all transactions are stored publicly, on the blockchain. Ignoring the fact that you could in theory create a DAO on a private blockchain, existing organisations, particularly those who could really benefit from the trust this would earn, like charities and governments, have always had the option of being fully transparent, but decided against it. The presence of DAOs as a new way to be transparent does not remove a bottleneck.

Early-growth: often the tokens that DAOs use to vote could be sold for a value that increases as the DAO becomes more prestigious and its treasury grows. In this way, those who participate early in a DAO when it is small can benefit by selling their tokens when it is large. To an extent, this is new, because financial securities laws would prevent it outside the world of web3, which has shifted norms of financial regulation. But I’m not focusing on it because it is not a DAO that makes this possible, it is the token, which is more to do with NFTs.

Future trends: to be a more speculative, I think in the 2030s it will be increasingly preferable for all kinds of organisations to set up using smart contracts. As someone who has navigated the UK rulebooks to set up private and charitable organisations, I look forward to the day when I can spin up a DAO and distribute voting rights in 10 minutes.

If you are a large token holder, then smaller holders centralising into one (perhaps through delegation) could bring a benefit of making these voters easier to collaborate with, which increases the meaningfulness of your influence because you need to convince fewer people to get what you want.

On Kleros, anyone can sign up as a jury member with an area of expertise, such as translation. The role of Kleros is to be an independent arbitrator that can verify whether some aspects of contracts have been fulfilled. It brings subjective decisions to web3 world that usually focuses on fact, such as who owns what, rather than ‘is this a sufficiently accurate translation?’.

The idea is that jury members with relevant expertise can cast a view on the accuracy of the translation and can challenge the views of others, and are incentivised to do so accurately with rewards, the benefit being that judgements can be reached quicker and more cheaply, without relying on a centralised authority who may have their own incentives. It is harder to extend such a court to areas where there is less potential for objective judgements though, such as ‘is this fair’. But it is very useful for cases such as the above. Combined with paying contractors via onchain escrow, DAOs can underlie a much cheaper, quicker way to enforce contracts.

Awesome write up, Leo. I'm looking forward to the next installment, and I'm going to use this for the next issue of Cryptocracy. Monday.

https://cryptocracy.substack.com/

This was one of the best coverages of DAOs I've read.

Looking forward to the next installments and your future writing.

I'd be curious to hear if you have any thoughts on 1-person-1-vote systems using DIDs or SBTs or something as a strategy to combat the potential of plutocracy that token-voting tends towards.